The Freight Metrics That Really Matter for CFOs

24 September 2025

Most CFOs see freight as a cost to minimise. But in 2025, freight is a finance lever - shaping cashflow, data accuracy, and even customer experience. Here’s why the metrics you track matter more than the rates you negotiate.

Freight is often imagined as trucks, ships, and containers quietly moving goods — until something goes wrong. But its impact runs deeper. Beneath the surface are flows of capital, risk, and resilience that shape a company’s financial health far more than line-item costs suggest.

In the turbulence of the mid-2020s, treating freight as a simple expense line leaves CFOs exposed. Freight has become a finance lever — influencing liquidity, forecasting accuracy, and customer trust. The real question is no longer “how much are we spending?” but “are we measuring the right exposures and opportunities?”

For CFOs, the task now is to move beyond invoices and rate tables and uncover the inefficiencies and hidden costs that never appear on a bill. Done right, freight becomes an untraditional but powerful lever for financial resilience and operational efficiency.

Let's unpack this further to uncover how we can use freight as an effective yet untraditional lever to drive operational efficiency.

Freight as a Finance Lever

When most CFOs think about freight metrics or freight KPIs, the reflex is simple: reduce costs, protect margins. It often becomes a race to the bottom. Yet freight is rarely just a line on a P&L. It is a strategic lever that influences cashflow, working capital, and even customer experience in ways that never show up on an invoice.

The world is a much more convoluted place in 2025, and this is forecasted to continue through 2026. Given this, the real question is not “how do we spend less on freight?” - it is “are we measuring the right things at all?”

Freight’s “Scope 3” Costs

In Sustainability Reporting, companies now account not only for direct emissions (Scope 1 and 2) but also indirect ones across their value chain (Scope 3). Freight deserves the same lens.

Consider tariffs in the US. They ripple through supply chains, shifting sourcing patterns and container flows. The impact eventually lands on a CFO’s desk as a subtle change in freight costs. If you only track invoices, you miss how global supply and demand elasticity quietly moves your numbers.

Freight costs are never confined to a bill. They creep in through systemic shocks, sourcing shifts, and the inefficiencies hidden inside your own operations.

From Macro Shocks to Micro Waste

Global ripples are one side of the equation. The other is the waste that happens inside your own four walls.

If it takes 15 minutes to load a consignment manually and you do thousands each month, you are burning hundreds of high-cost labour hours. The ROI of automating this process is not theoretical. A fixed OpEx subscription to a Freight Management System can release executive time, accelerate reconciliations, and improve forecasting accuracy.

If you only measure invoices, you miss both ends of the spectrum: the macro shocks and the everyday leakages. Let's unpack what those leakages look like though.

For Want of a Nail: The Cost of Bad Data

There’s an old proverb: “For want of a nail, the shoe was lost…”. In freight finance, one incorrect freight record can ripple into misstated COGS, inaccurate forecasts, and board packs that undermine confidence in the numbers.

By the time the error surfaces, the damage is multiplied. Poor data is its own form of Scope 3 exposure: indirect, invisible at first, and cascading through financial statements long after the cause.

For a CFO, this is less about an ops problem, and more a financial reporting risk. Therefore, we can see that freight isn’t just a line on a P&L; rather a finance strategy.

The Real Cost Isn’t Always Price

Chasing the lowest freight rate looks good on paper. In practice, it can create hidden costs.

Imagine paying a 5 percent premium for a pallet that arrives three days earlier. That faster turnaround may free up cashflow, reduce working capital, or prevent lost sales. The opportunity cost of waiting can outweigh the saving.

The same applies to executive time. A CFO doing invoice reconciliation might feel in control, but every senior role carries an implied hourly rate. Once you put a number on it, automation pays for itself.

Therefore, capital allocation decisions can create enterprise value tomorrow, if we think further than just chasing the cheapest invoice of today. At the very least, you should have visibility which grants you choice, even if it makes sense to go with the cheapest provider most of the time. But how can we leverage technology to achieve this?

Automation as the New Calculator

Nobody questions an accountant using a calculator. It ensures accuracy and frees their expertise for higher-order work. Freight finance should be treated the same way Automation does not remove admin; rather it changes its nature. Manual reconciliation becomes oversight. Time lost to grunt work is redirected to decisions that move the business forward. Seen in this light, automation is more than just an efficiency tool. It is a safeguard for accuracy, speed, and financial resilience. These freight performance indicators therefore are not just operational - they are critical supply chain finance metrics that determine cash cycle and reporting accuracy.The Two Freight KPIs That Matter Most

While freight produces endless variables and line items, only two metrics consistently determine whether a business runs efficiently or bleeds value.

- Time: Transit time, reconciliation time, cash cycle time. Freight is one of the most overlooked time drains in the business, yet time is the hidden currency that defines efficiency.

- Fixed Costs: Variables like fuel or tariffs are largely uncontrollable. What you can control are fixed overheads — leases, fleet commitments, contracted minimums. Master these and you unlock predictability.

Everything else is noise, if the first two aren’t optimised.

Freight as Finance Strategy

Freight should not be treated as procurement, rather a finance strategy.

The CFO who only looks at freight as a negotiable line-item risks missing the bigger picture: indirect costs, cascading errors, lost opportunities, and wasted leadership hours. The ones who get it right will see faster cycles, cleaner data, lower overheads, and tighter control of the business’s financial truth.

The metrics that matter most are less on the invoice, rather they reveal the true cost of the one equaliser: time.

Freight doesn’t need to stay hidden on the P&L. For CFOs willing to treat it as part of their finance strategy, the payoff is visibility, predictability, and control — the tools you need to keep volatility in check and make sharper decisions. The only question is whether you’ll use the data already in front of you to get ahead, or wait until the next disruption forces your hand.Ready to Turn Freight Into a Finance Advantage?

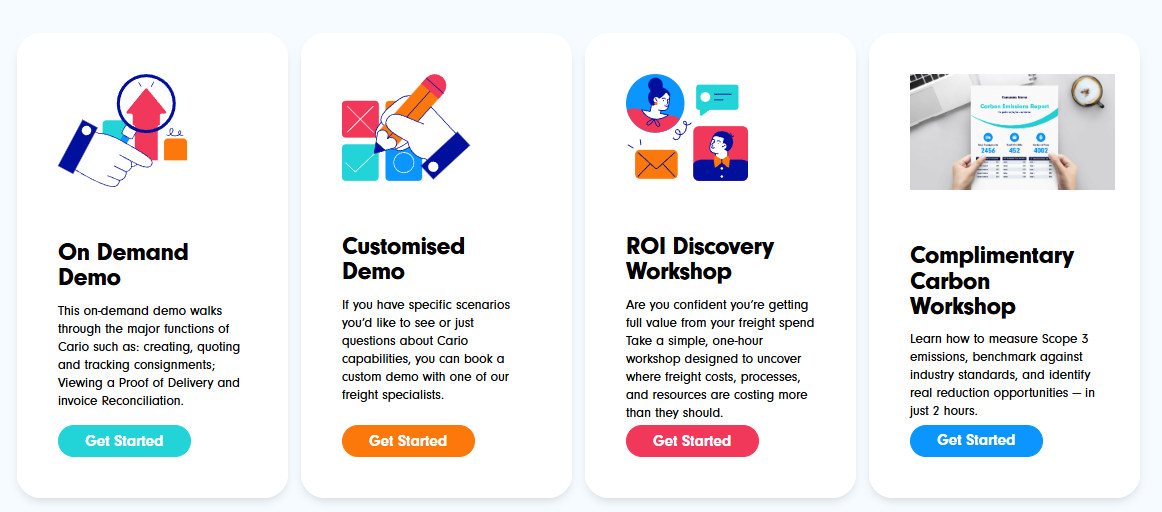

Cario helps CFOs and finance teams move beyond freight as a cost centre. With end-to-end visibility, automation, and smart metrics, you can streamline operations and strengthen financial performance.